federal income tax canada

10 12 22 24 32 35 and 37. In 2023 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1.

Pdf The Federal Income Tax Act And Private Law In Canada Complementarity Dissociation And Canadian Bijuralism David Duff Academia Edu

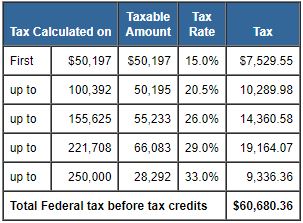

15 on the first 50197 of taxable income 205 on the amount over 50197 up to 100392 26 on the amount over 100392 up to 155625 29 on the amount over.

. The federal tax brackets are calculated every. There are seven federal tax brackets for the 2021 tax year. Jobs and the workplace.

These are the rates for. Your bracket depends on your taxable income and filing status. Since 2000 the federal government has continued to reduce personal income taxes.

Total federal tax payable. The personal income tax rate in Canada is progressive and assessed both on the federal level and the provincial level. Menu Main Menu.

Who should file a tax return how to get ready for taxes. Recognising that Quebec collects its own tax federal income tax is reduced by 165 of basic federal tax for Quebec residents. Average tax rate 000 Marginal tax rate 000 Summary Please enter your income deductions gains dividends and taxes paid to get a summary of your results.

Pay 15 on the amount up to 49020 or 735300. The following are the federal tax rates for 2021 according to the Canada Revenue Agency CRA. File taxes and get tax information for individuals businesses charities and trusts.

Federal personal base amount is. The struggling economy and a political crisis resulting from conscription triggered its. 350634 42184 at a.

The government has also introduced new tax. The highest marginal federal tax rate is now 33. Total federal income taxes might be.

If your taxable income is less than the 50197 threshold you pay. 960390 49020 at a 15 tax rate then 10980 at 205 a tax rate Total provincial income taxes would be. Income tax GSTHST Payroll Business number Savings and pension plans Child and family benefits.

In 2020 Canadian federal income tax brackets and base amount were indexed by 1019 factor. Canada utilizes a graduated income tax system which simply means that the more money you earn the higher the taxes you pay. 2023 Federal Income Tax Bracket s and Rates.

Federal tax rates range from 15 to 33 depending on your income while. 58 rows Thats in the second tax bracket both federally and provincially. 15 on the first 49020 of taxable income and 205 on the portion of taxable.

Federal income tax was initiated in Canada in 1917 to help finance the First World War. Canada follows a progressive tax system which means higher the. The federal government charges you 15 on the first 49020 you made minus the federal exemption of 13808 and.

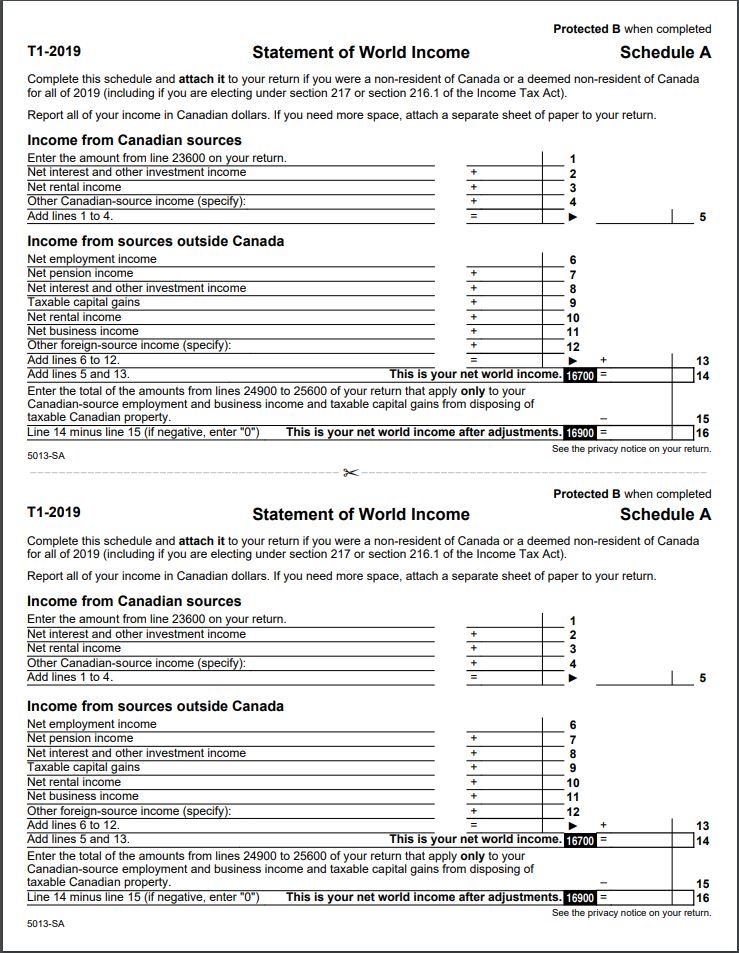

Instead of provincial or territorial tax non-residents. The federal government collects both these taxes for all provinces except Quebec which has its own taxation system. This is how the calculation looks.

How Canadas personal income tax brackets work How much federal tax do I have to pay based on my income. Pay 205 on the amount between 49020 to 98040 or 20090. All tax brackets and base amount were increased by 19.

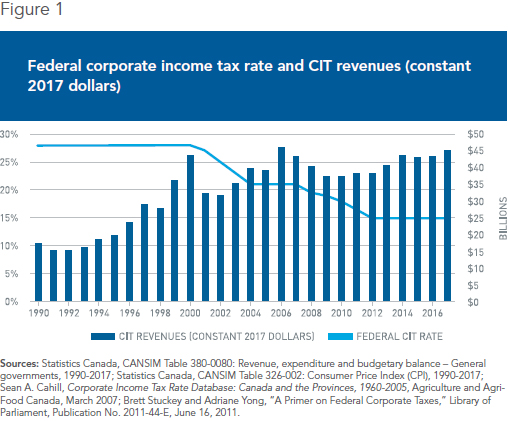

Canada S Corporate Tax Cut Success A Lesson For Americans Iedm Mei

High Income Earners Need Specialized Advice Investment Executive

Introduction To Federal Income Taxation 2012 2013 In Canada 33rd Edition Beam Solutions Manual By Meyer Issuu

Canadians May Pay More Taxes Than Americans But There S A Catch

Federal Corporate Income Tax Revenues Actual And As A Percentage Of Download Table

Personal Income Tax Brackets Ontario 2019 Md Tax

Taxtips Ca How Is Personal Income Tax Calculated In Canada

Calculate Your Personal Income Tax In Canada For 2020 2021 Credit Finance

Winter 2021 Canadian Income Tax Highlights Cardinal Point Wealth Management

2022 Tax Rates Brackets Credits Combined Federal Provincial Tax Brackets Manulife Investment Management

Alberta Accounted For 97 Of Federal Income Tax Decline During Recession S Height Cbc News

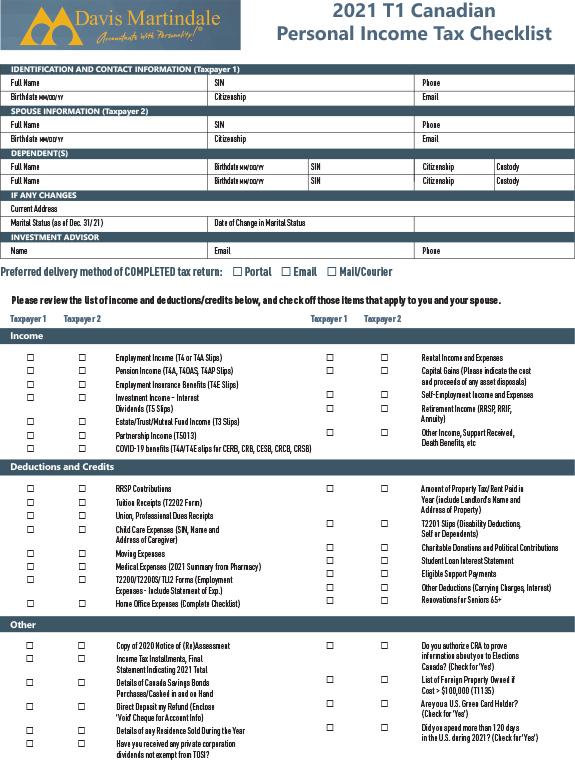

2021 Canadian Personal Income Tax Checklist Davis Martindale

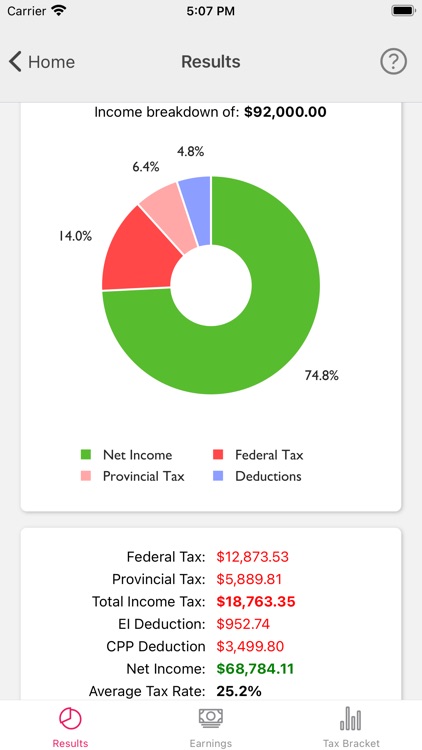

Canada Income Tax Calculator By David Xu

Personal Income Tax Brackets Ontario 2020 Md Tax

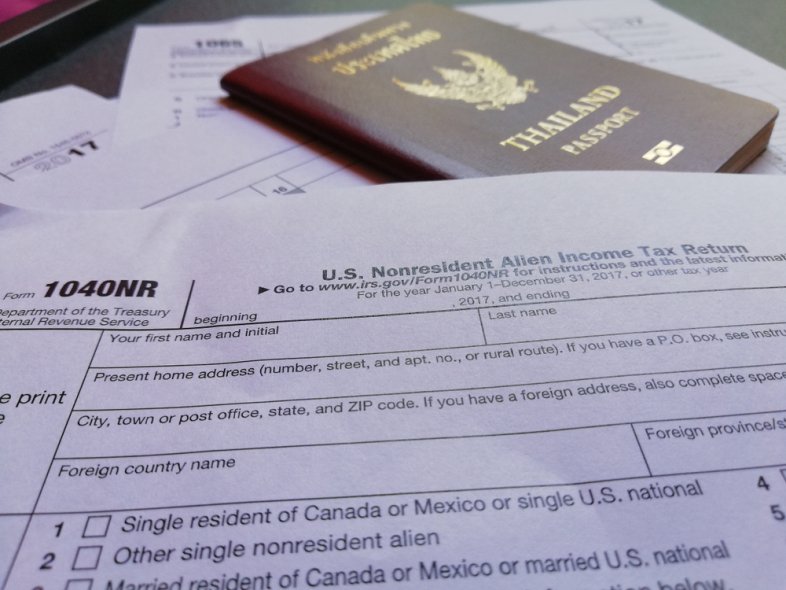

What Non U S Citizens Should Know About Filing Taxes Mybanktracker

Top Combined Personal Income Tax Rate In Canadian Provinces In 2016 Infographic Jpg Fraser Institute

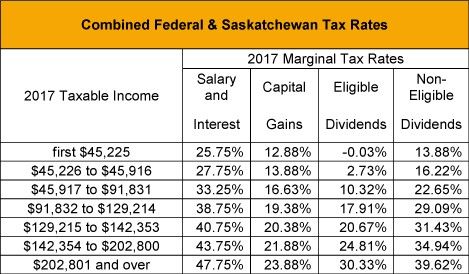

Saskatchewan 2017 Budget Sales Taxes Vat Gst Canada

What Exactly Is Canada S Federal Income Tax Act 2022 Turbotax Canada Tips

Thesis The Federal Income Tax In Canada Id Rx913s67b Escholarship Mcgill